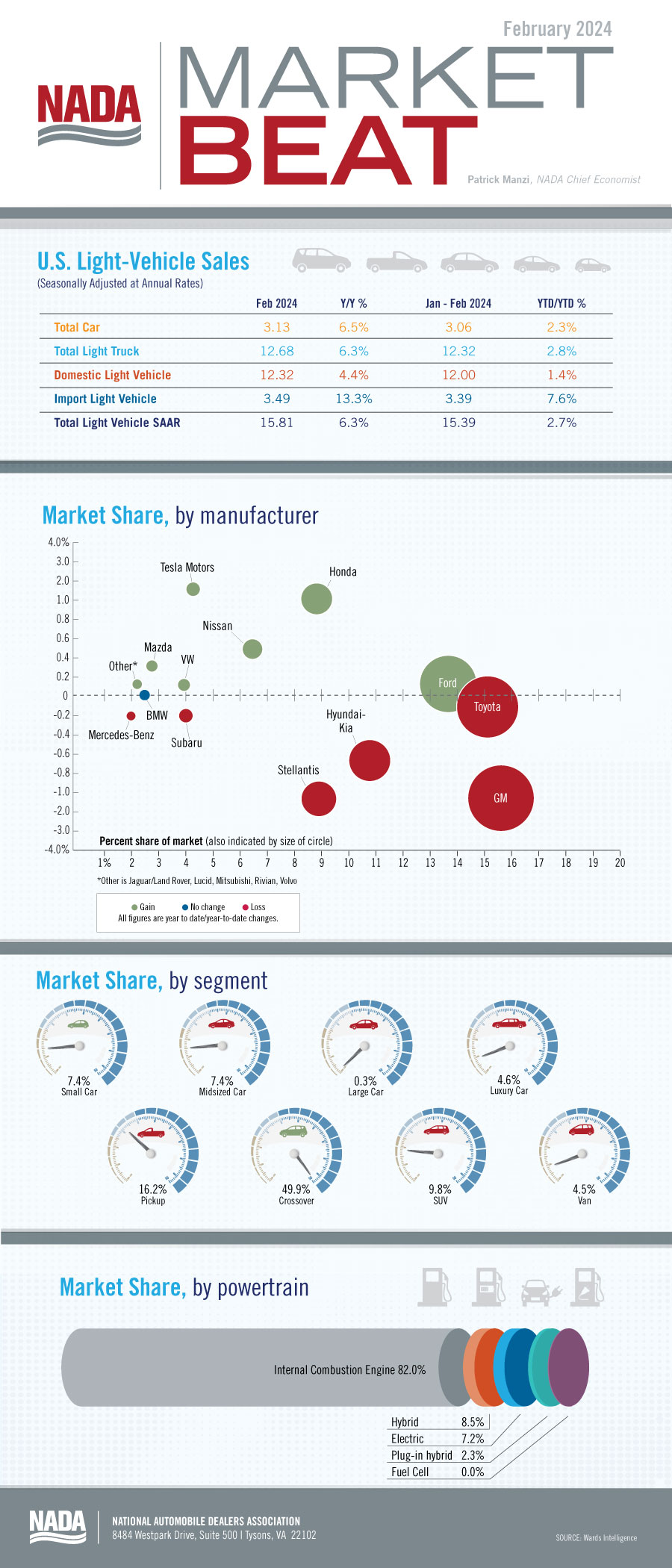

New light-vehicle sales for February 2024 exceeded expectations. February 2024’s SAAR totaled 15.8 million units, up 6.3% from February 2023 and up 6% from January 2024, which had seen a 10-month low. More vehicles on dealer lots coupled with higher OEM incentives helped drive the sales increase.

According to J.D. Power, average incentive spending per unit is expected to total $2,565 in February—an increase of 75.3% year over year and the highest level since May 2021. One of the drivers of increased incentive spending, says J.D. Power, is more OEM incentives for leasing. In February 2024, leasing will likely account for 23.2% of retail sales. Despite higher incentives and a lower average transaction price of $44,045 in February—which was down $1,919 year over year—the average monthly payment on a new-vehicle finance contract should remain flat year over year at $722, says J.D. Power.

The crossover segment continues to grow and remains the largest new-vehicle segment in the industry. Through February 2024, crossovers made up 49.9% of all new vehicles sold, up 3.2 percentage points in market share from the same period last year. Alternative-fuel vehicles represented 18% of all new vehicles sold through February 2024, an increase of 3.6 percentage points in market share compared with the same period in 2023. Hybrids have seen the largest market share jump so far this year, rising 2.7 percentage points year over year to 8.5%.

For the rest of the year, we expect to see inventory continue to increase gradually and OEM incentive spending to follow suit. The industry will continue to stabilize throughout 2024. Our annual forecast for new light-vehicle sales is 15.9 million units.

NADA Market Beat: February 2024 New Light-Vehicle Sales Finish Strong

Published

Author

Image

Image